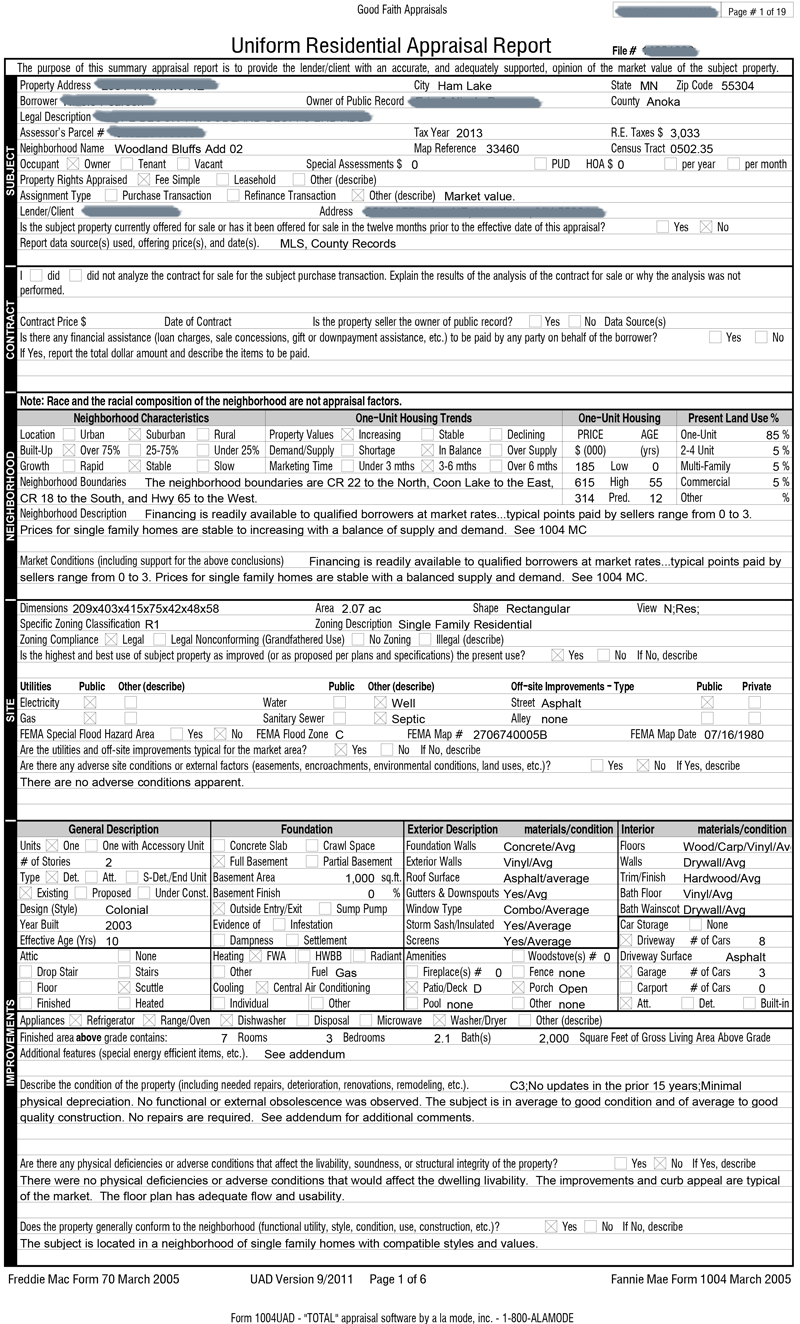

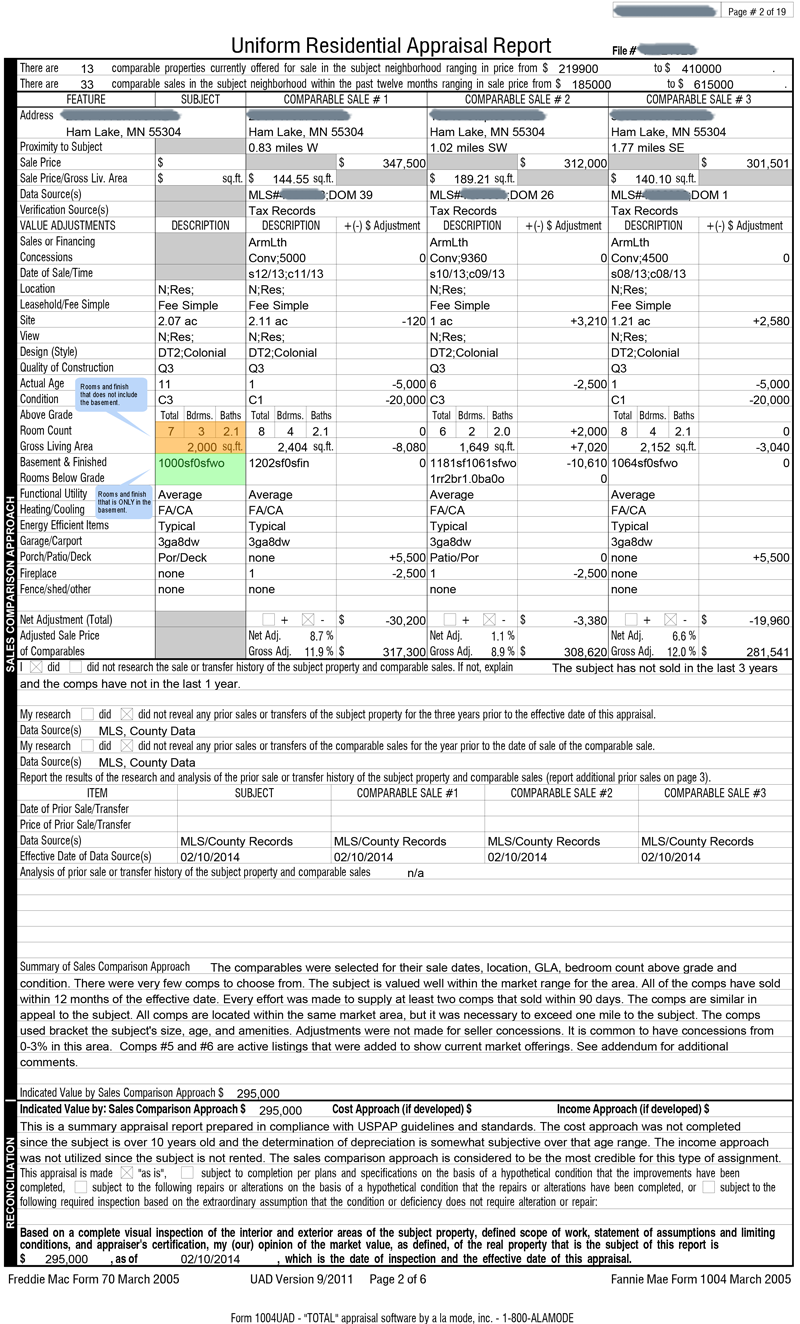

What is a Real Estate Appraisal?An appraisal is a written document or verbal report that shows an opinion of how much a property is worth. The appraisal gives useful information about the property. It describes what makes it valuable, and shows how it compares to other properties in the neighborhood. An appraisal helps assure you and your lender that the value of the property is based on facts, not just the seller’s opinion. Real estate appraisal, property valuation, or land valuation, is the process of valuing real property. The value usually sought is the property's market value. Appraisals are needed because real estate transactions occur very infrequently on any individual property. Not only that, but every property is different from the next. Furthermore, all properties differ from each other in their location - which is an important factor in their value. Because of this fact, a specialized, qualified appraiser is needed to advise on the value of a property. The appraiser usually provides a written report on this value to his or her client. These reports are used as the basis for mortgage loans, for settling estates, for tax matters, and many other purposes. Sometimes the appraisal report is used by both parties to set the sale price of the property appraised. So Remember... An appraisal is an opinion, not a fact. However, it is a very educated opinion. Your house may or may not sell for the appraised value, but it should be close. This is why it is critical to get use an appraiser that can be trusted for accuracy. Good Faith Appraisals is trusted by the largest lenders, small community banks, mortgage companies, real estate agents, and on and on... Sample of Page 1 & 2 of a standard 1004 URAR

|

Got a Question?

Do you have a question relating to real estate appraisals? We can help. Simply fill out the form below and we'll contact you with the answer, with no obligation to you. We guarantee your privacy.